Beware of these Pandemic Phishing Scams

These days, even though we are all, for the most part, stuck at home, trying to be safe from COVID-19, that doesn’t mean that we are safe from cybercrime. Cybercriminals continue to target victims, even in this environment, and many of these scams are related to COVID-19. This is pretty common when something like a crisis comes down, so you have to remain vigilant as you go through your daily life. Here are some of the things you should be looking for and being aware of:

Relief Fund Scams

Relief Fund Scams

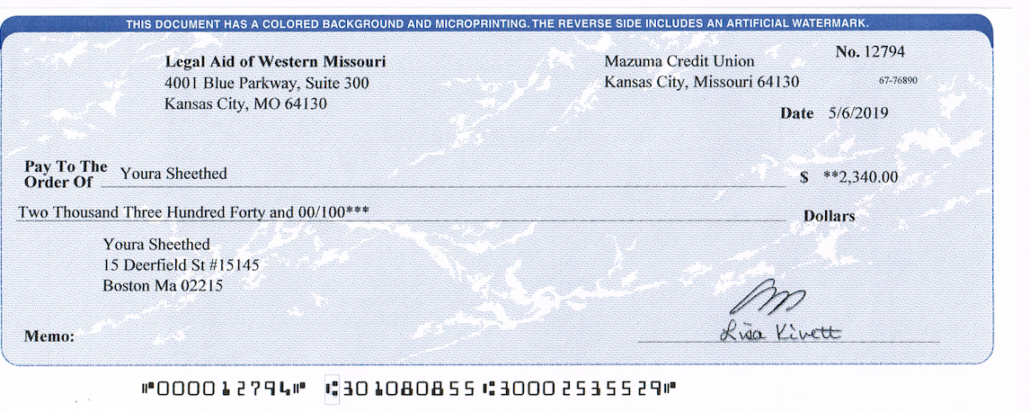

As we look towards our government officials for help, they have been sending out money to people who have lost their jobs or become impacted financially by the COVID-19 crisis. Criminals have started to create phishing scams that look identical to the correspondence that might come from the government. They do this to trick people into revealing their personal information. Currently, if you are in the UK, Australia, or the US, you are probably being targeted.

Infection Maps that are Malicious

Cybercriminals are also taking advantage of the public’s interest in COVID-19 infection maps. Organizations like Johns Hopkins are creating these maps, but cybercriminals are following close behind and releasing their own. All they have to do is set up their own websites, and then stick malware in them. They can do this for little to no money, and then they can make a huge profit thanks to ID theft and other dastardly deeds.

Impersonating Official Health Organizations

You also need to keep an eye out for cybercriminals who are impersonating official health organizations, including WHO – the World Health Organization, or the CDC – Centers for Disease Control. They are doing this by designing a number of different phishing scams. These started all the way back in February, and they are continuing to be sent. The criminals are setting up a sense of urgency, so that people are more apt to give up their information.

Scams with COVID-19 Testing Kits

There is also a lot of interest in COVID-19 testing kits, and as you might imagine…the bad guys are targeting these people, too. Not only are these scams spreading via email, according to the FCC, Federal Communications Commission, but also with robocalls, text smishing, and more. The FCC has even announced that it has found a big range of robocall scams that are associated with coronavirus, including things like debt consolidation, work at home opportunities, and even student loan repayment plans. There are also specific scams that are targeting small businesses.

Medical Supply Scams

Finally, we have medical supply scams. These are similar to the testing kit scams but the cybercriminals are using these medical supplies, like masks and gloves, as a lure to get people to give them money. There are more and more of these websites popping up with huge discounts on medical supplies. Many of these sites are offering limited-time sales and want Bitcoin for payment, which is a big sign that you could be getting scammed.

ROBERT SICILIANO CSP, is a #1 Best Selling Amazon author, CEO of CreditParent.com, the architect of the CSI Protection certification; a Cyber Social and Identity and Personal Protection security awareness training program and the home security expert for Porch.com

IRS Commissioner, Chuck Rettig, has been urging people to take more care during this time. He reminds taxpayers that the IRS won’t ever call to verify or collect financial information in order for you to get your refund faster. The IRS will also never email taxpayers asking for this information. Fraudulent text messages are also on the rise.

IRS Commissioner, Chuck Rettig, has been urging people to take more care during this time. He reminds taxpayers that the IRS won’t ever call to verify or collect financial information in order for you to get your refund faster. The IRS will also never email taxpayers asking for this information. Fraudulent text messages are also on the rise. All year but especially during tax filing season, the IRS will see a big surge in the number of scam calls, which tell victims that they will be arrested, deported, or have their driver’s license revoked if they don’t pay a fake tax bill.

All year but especially during tax filing season, the IRS will see a big surge in the number of scam calls, which tell victims that they will be arrested, deported, or have their driver’s license revoked if they don’t pay a fake tax bill.

Fake Bitcoin Exchanges

Fake Bitcoin Exchanges One such scam occurs when criminals call random phone numbers and ask questions, such as “Can you hear me?” When you say “yes,” they record it. They then bill you for a service or product, and when you try to fight it, they say…but you said ‘Yes.’ Not only does this happen with private numbers, it also happens with businesses. So, you have to ask…are you aware of the possibility of scams, or are you a sitting duck just waiting to be targeted? HOWEVER, this scam is unproven. Meaning I don’t think it’s a scam at all. And the scam is that this is not a scam!

One such scam occurs when criminals call random phone numbers and ask questions, such as “Can you hear me?” When you say “yes,” they record it. They then bill you for a service or product, and when you try to fight it, they say…but you said ‘Yes.’ Not only does this happen with private numbers, it also happens with businesses. So, you have to ask…are you aware of the possibility of scams, or are you a sitting duck just waiting to be targeted? HOWEVER, this scam is unproven. Meaning I don’t think it’s a scam at all. And the scam is that this is not a scam!