Who Has Access to Your Personal Info? The Answer Might Surprise You

Are you aware that many people probably have access to your personal info? If you have ever gotten an apartment, have insurance, or applied for a job, someone has done a background check on you, and you might be shocked by what’s in there, including your debts, income, loan payments, and more. On top of this, there are also companies collecting information on you including:

- Lenders

- Employers

- Government agencies

- Volunteer organizations

- Landlords

- Banks/credit unions

- Insurance companies

- Debt collectors

- Utility companies…and more

Thanks to the Fair Credit Reporting Act (FCRA), you can get a copy of these reports every year for a small fee, and they are free if there has been any type of adverse action against you. You can also get this information from certain organizations including the following:

Credit Agencies

Most people know the main credit reporting bureaus, Experian, TransUnion, and Equifax. The reports that these companies give you can include your loan and credit card payment history, how much credit you have, info from debt collectors, and other information.

Employment Screening

If you have applied for a job, you might have gone through employee screening. These employers have access to things like your salary history, credit history, education, and even criminal history.

Housing/Tenant Screening

If you have ever rented an apartment or home, your landlord might have done a background check, too. This might include prior evictions and other negative information.

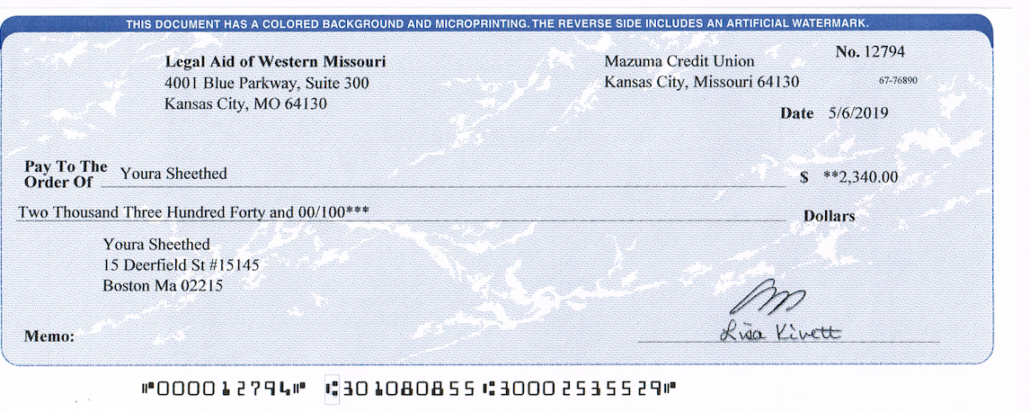

Banking and Check Screening

Your bank also might have information on you, which could include your banking history, such as negative balances on your checking account or unpaid bills.

Medical Insurance

Finally, if you have medical insurance, your insurance company has probably also done a background check on you. These policies include life insurance, health insurance, long-term care insurance, critical illness insurance, or disability insurance.

Lifehacker and the Consumer Financial Protection Bureau’s 2019 report compiled a pretty amazing list below. Check it out.

- Accurate Background

- American DataBank

- Backgroundchecks.com

- Checkr: request it here

- EmpInfo:

- First Advantage Corporation:

- General Information Services, Inc.:

- HireRight:

- Info Cubic:

- IntelliCorp:

- OPENonline:

- PeopleFacts:

- Pre-employ.com:

- Sterling Talent Solutions:

- Truework

- The Work Number:

The nice thing about these things, however, is that you have a right to access all of these reports, too. In most cases, these reports are free. You can ask these organizations what background check companies they are using, and then you might be able to request a free report. Again, if there is any negative information on these reports that cause you to, for instance, not be hired by an employer, you will automatically get a free copy of this report so you can see the derogatory information for yourself, and then take any steps you can to change it.

Robert Siciliano personal security and identity theft expert and speaker is the author of Identity Theft Privacy: Security Protection and Fraud Prevention: Your Guide to Protecting Yourself from Identity Theft and Computer Fraud. See him knock’em dead in this Security Awareness Training video.