Protecting Your Social Security Number

Many people wonder if it is safe in certain situations to give out their Social Security number. We sure are asked for it a lot, but do you have to give it? When is it necessary? Here is some perspective:

One of the best rules you can live by is this: just because a person asks for your Social Security number, it doesn’t mean you have to give it. But also remember there are situations where you will not be provided various services unless you get it out.

You might feel that you have to, though, and freely give it. This could be a huge mistake, though. There are many times when you want to, though, and you should, but you have to do it with discretion.

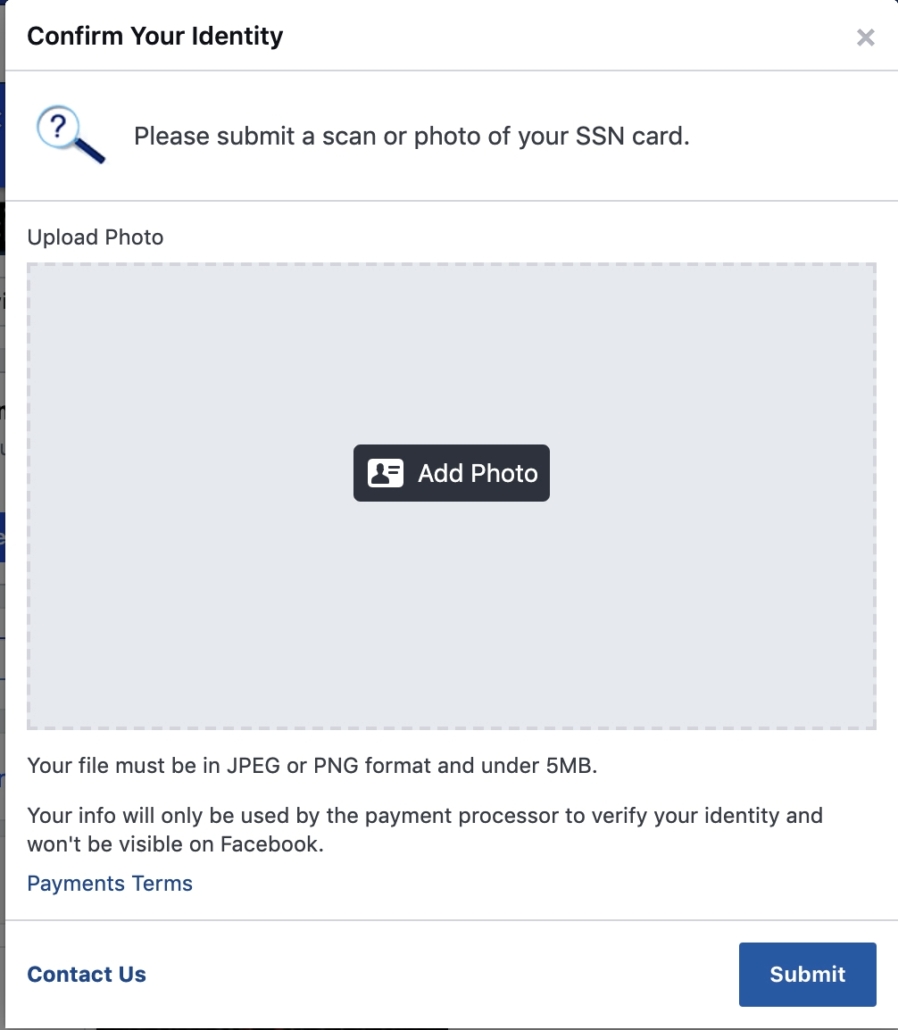

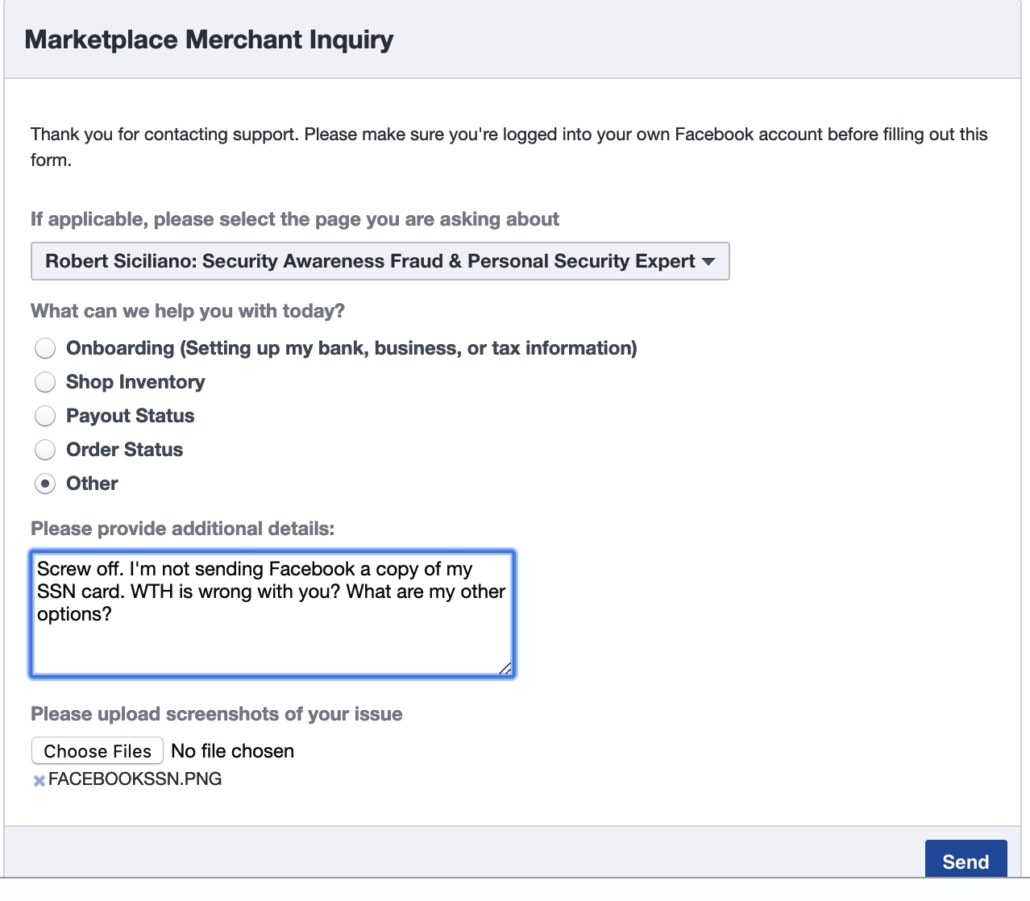

Here’s the thing. Some of the people and organizations that ask for your Social Security number really have no business asking. Even when they ask for the last four digits of your SSN, don’t give that out, either, unless you know that the company already has it on file.

Really, when the IRS is involved, or other government agencies, or it is something financial that’s credit driven, such as getting a loan, you likely need to give out your Social Security number. In other cases, like applying for a job, you can tell a business you are not comfortable giving your number unless you are hired, and then they would need it for tax purposes.

I give out my Social Security number when required, with a little scrutiny, but in the end, I’m not worried about identity theft due to the fact that I have ID theft protection and a credit freeze which in most cases makes my Social Security number useless to a thief.

Tips to Protect Your Social Security Number

Here are some tips you can use to protect your Social Security number:

- Don’t put your SSN on any written application or document. If your application is denied because of this, ask them if it’s really necessary, otherwise, give them your SSN.

- Ask your bank if they absolutely require your SSN to verify your identity. There are other options they can use. But the Patriot Act might require it.

- Consider extending your ID theft protection to include your children’s SSNs. Teach them to never give it out.

- If you are at the doctor’s office, find out if you can use another number, such as the account number for your insurance.

- Don’t send your SSN via email. If someone wants it, call them and give it to them verbally. Even then, don’t give the number out unless you know without a doubt that it’s legitimate.

- You should get a statement from the Social Security Administration concerning your account each year. If your income is too high, someone else is probably using your number.

- Don’t keep your Social Security card in your wallet. Instead, memorize the number and keep the card at home.

- Don’t ever use your SSN as a password for anything.

- If, for any reason, your SSN is in your PC, make sure the document is encrypted or password-protected.

- Before you throw away any paperwork that has your SSN on it, black it out, and then shred the documents.

Really, all you have to do is have some common sense when it comes to your Social Security number. For instance, if you are applying for credit, it makes sense that they would need this. If you are getting a gym membership, unless they are granting a credit, they don’t need it.

Written by Robert Siciliano, CEO of Credit Parent, Head of Training & Security Awareness Expert at Protect Now, #1 Best Selling Amazon author, Media Personality & Architect of CSI Protection Certification.

Thanks to this type of identity theft, however, we can see that our credit system is very vulnerable. Essentially, it tells us that it is very easy to create a credit file by using this information, and once they do, they can get a loan or credit card with the information of their victims.

Thanks to this type of identity theft, however, we can see that our credit system is very vulnerable. Essentially, it tells us that it is very easy to create a credit file by using this information, and once they do, they can get a loan or credit card with the information of their victims. Most people take for granted that Uber does background checks on its drivers, but there are actually a number of shady drivers who have recently been accused of crime, and it’s definitely not the first time they have had run ins with law enforcement. Some of these people are accused of committing crimes against their passengers, and that’s where things really get scary.

Most people take for granted that Uber does background checks on its drivers, but there are actually a number of shady drivers who have recently been accused of crime, and it’s definitely not the first time they have had run ins with law enforcement. Some of these people are accused of committing crimes against their passengers, and that’s where things really get scary. All year but especially during tax filing season, the IRS will see a big surge in the number of scam calls, which tell victims that they will be arrested, deported, or have their driver’s license revoked if they don’t pay a fake tax bill.

All year but especially during tax filing season, the IRS will see a big surge in the number of scam calls, which tell victims that they will be arrested, deported, or have their driver’s license revoked if they don’t pay a fake tax bill.

How do Hackers Steal Frequent Flyer Miles?

How do Hackers Steal Frequent Flyer Miles? The scam started out fairly small and localized, but now, people from across the country are reporting that they are getting calls from people stating that they are from the Social Security Administration. The caller attempts to get personal information from the person they call including address and banking information.

The scam started out fairly small and localized, but now, people from across the country are reporting that they are getting calls from people stating that they are from the Social Security Administration. The caller attempts to get personal information from the person they call including address and banking information. This type of identity theft shows us that our credit system is more vulnerable than we might think. Basically, it is easy to create a credit file on these identities, and once they have that, they can get a credit card or loan.

This type of identity theft shows us that our credit system is more vulnerable than we might think. Basically, it is easy to create a credit file on these identities, and once they have that, they can get a credit card or loan.